With the continued evolution of digital banking technologies, it will become more important than ever for banks to stay at the forefront of identifying and mitigating risks.

Most, if not all, Australian banks have begun their implementation of machine learning algorithms to detect fraudulent activity, together with the adoption of natural language processing (NLP) technologies to analyse customer accounts for potential risks. Now we are seeing organisations look to mature their efforts and ensure that their risk management outcomes maintain their long-term effectiveness and sustainability.

Through the next few years, there will continue to be a significant focus on cybersecurity, combined with the use of blockchain technology to secure sensitive financial data.

Biometrics and other forms of identity verification may also become more prominent to help reduce the risk of identity theft.

By utilising digital banking technology, banks and financial service providers concerned about the effectiveness of their risk management practices can ensure the safety and security of customers’ financial information, while taking advantage of the many benefits that digital banking technologies will bring to the table.

9Yards Senior Consultant, Tatiana Konnova says that these initiatives are only as good as the data they utilise. “Quality data delivered as close as possible to the real time will drive accurate, targeted predictions the defence mechanism relies upon – while incomplete, limited or outdated data could trigger wrong and untimely predictions.”

This, she warns, can lead to weakened defences against external threats, as well as human error amongst internal staff.

The use of data analytics in digital banking for risk management

Technological innovations in data analytics already work to identify and assess potential risks. The maturation and sustainability of these efforts will be a key area of focus and improvement for banks and financial service providers in the coming years.

They can use data analytics to identify patterns of behaviour that may indicate a risk, such as unusual account activity, or an increase in customer complaints. This helps proactively identify potential risks, and take the necessary steps to mitigate them before any losses are incurred.

Let’s take a look at three examples of areas where banks and other financial service providers can utilise data analytics for the purpose of risk management:

1. Risk modelling

For investment banks, consistent and correct risk model management reduces a portfolio’s overall performance – but when assets are volatile, this becomes quite a challenge.

Data analytics can be used to provide greater depth into risk modelling across all assets. For example, not only can risk be mitigated – data can reveal how much it will cost, how expected returns might be, and what probabilities are involved… all before a decision is made.

2. Credit risk analysis

By analysing historical credit data, borrower creditworthiness can be greatly understood to determine the level of risk associated with loans and credit. As technological capabilities increase, the picture for each individual customer or applicant becomes clearer, with many types of data being monitored. For example, this could include their customer credit score, or their total debt.

This type of data analysis helps banks and financial institutions evaluate their risks by reducing the likelihood of granting loans or credit to customers who are less than ideal candidates.

3. Fraud detection, reduction and prevention

Reducing instances of fraud is a common goal for most banks and financial service providers, with 93% of Australian consumers worried about digital bank fraud, according to a study by Entrust.

Fortunately, not only can data analytics help detect fraud, it can also manage risk potential and prevent it before it even occurs.

For example, individual customers can be rated on the basis of how likely it is that they are at risk of fraud. Differing levels of monitoring and verification can then be applied to their accounts. As a result, data analytics gives banks and financial service providers a strategic glimpse into the areas where they should focus their fraud detection priorities.

The adoption of machine learning and artificial intelligence

Most industries have already begun their adoption of machine learning and AI techniques. For example, eBay and Amazon both use these technologies to recommend personalised products. Google has email spam recognition capabilities, and Netflix easily suggests films based on ones you have watched previously.

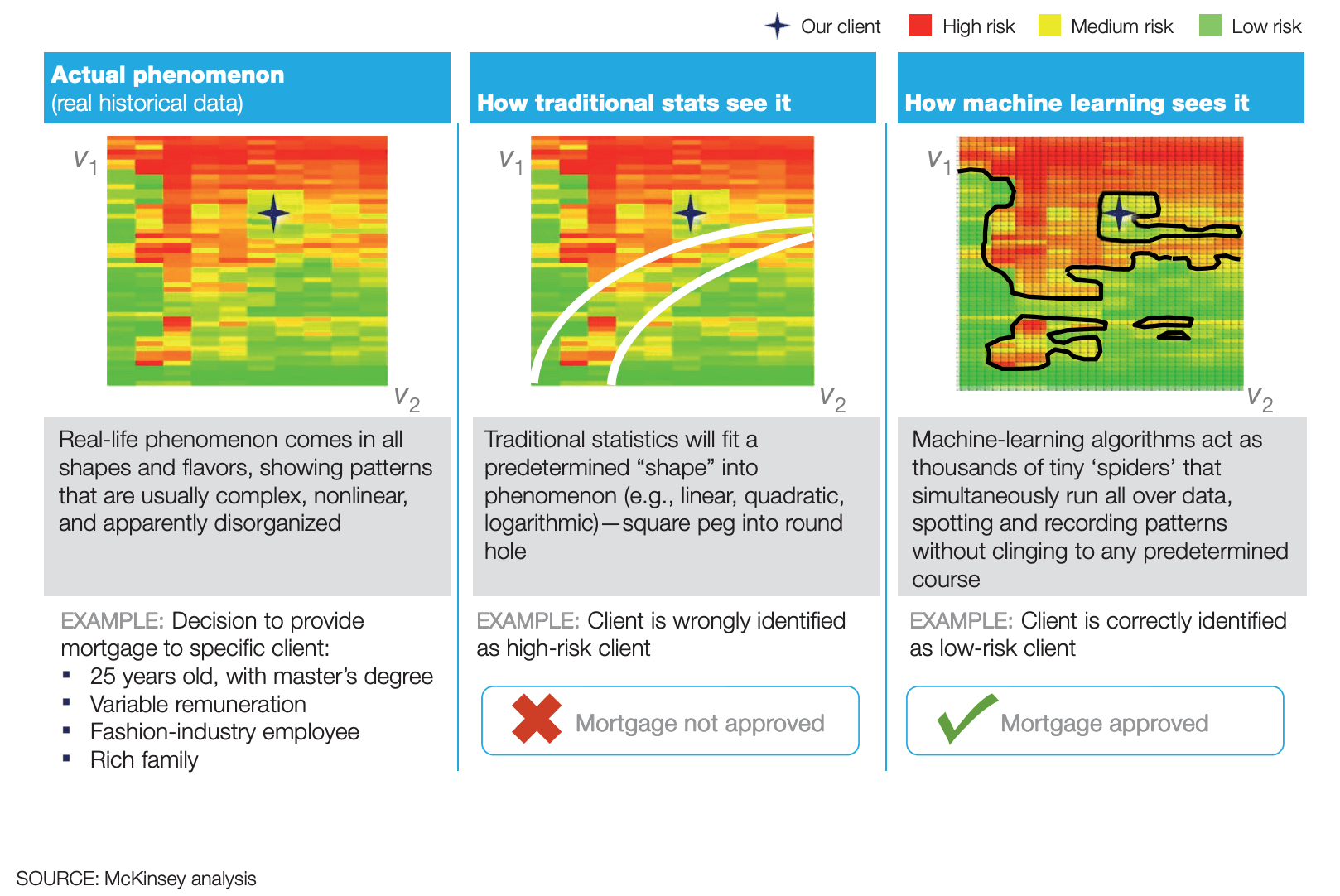

Banks and financial institutions have already begun using this rapidly evolving technology, providing them with much deeper insights than what was previously available. It has the ability to identify complex, nonlinear patterns in large data sets, to ultimately make risk models that are far more accurate, and improve this accuracy over time as it continues learning (see below).

* Screenshot source: McKinsey’s The Future of Bank Risk Management

In the coming years, we are likely to see the continual adoption and application of machine learning in areas such as financial crime detection, credit underwriting, collections in the SME sector, in addition to early warning systems.

Nevertheless, adoption won’t be without challenges. Once widespread adoption of machine learning and AI is reached, the self-learning models may face difficulties in validation through traditional means. Despite this challenge, banks and financial service providers are likely to use this technology for other purposes anyway, due to their efficiency and accuracy in application.

Learn More

Does your bank or financial services institution need assistance with developing a cross-functional approach to risk management technology? Reach out to our team to get started.