When we talk about digital transformation, we often discuss technology in the same breath. Yet it’s important to remember that digital transformation is not just about technology.

For financial services, banking and insurance organisations, customer experience (CX) has a huge impact on customer retention and business growth. That also makes it a core driver for digital transformation.

With a CX focus, digital transformation enhances your services, ensuring they are simple, personalised, fast, integrated seamlessly across multiple channels and – most importantly of all – designed around the preferences and needs of your customers.

A CX focus will prioritise customer experience over channel choice

By far the most significant challenge for organisations undergoing digital transformation comes about when they do not engage customers to understand their needs and preferences.

Recent research by Gartner shows that customer insights are key to a successful CX approach and include:

- deep customer knowledge

- customer-centric culture

- CX-first channel selection

- powerful CX journeys.

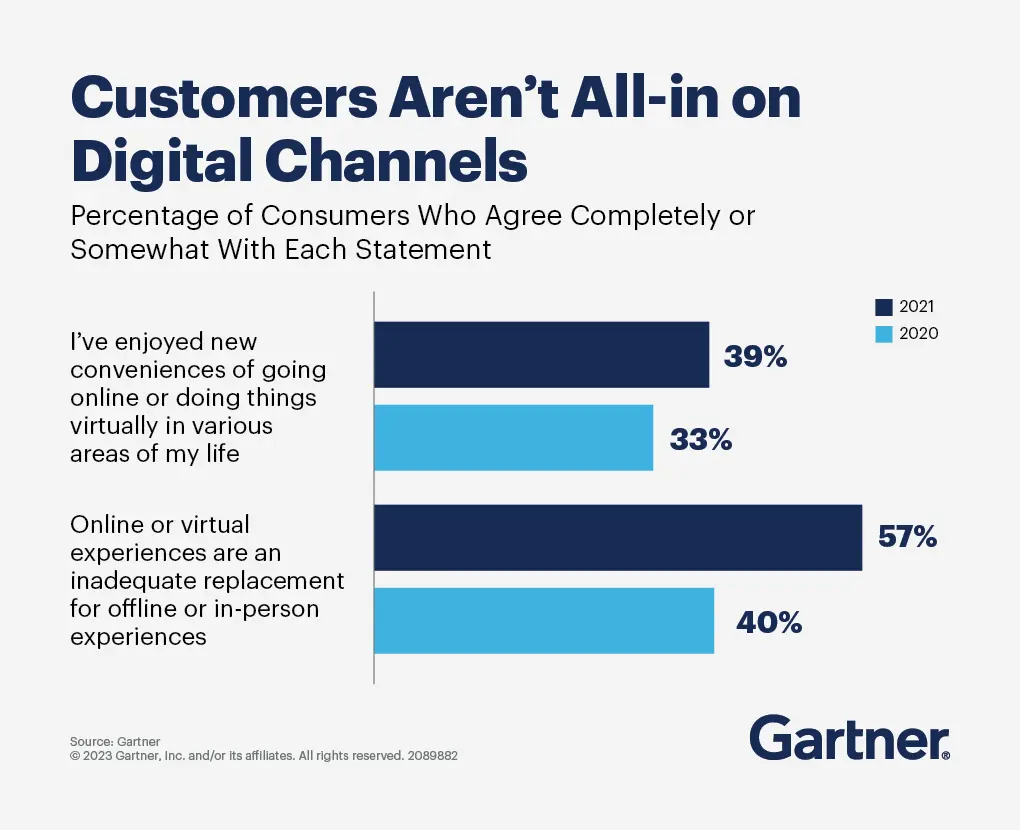

Gartner reminds organisations to “prioritise customer experience, not channels, to drive customer loyalty” and provides data that shows a significant number of customers find digital experiences to be an ‘inadequate replacement for offline or in-person experiences”.

That’s not to say that digital transformation is a doomed exercise.

What it underscores instead, is the importance of understanding what your customers need, as a core part of your digital transformation strategy. If your customers need the option to connect in-person or offline, that’s a requirement that should not be ignored in favour of a digital-only experience. And the requirement needs to be built into your digital transformation strategy, with omnichannel integration.

In other words, Let humans handle human tasks – and AI handle the rest.

In their 2024 CX predictions feature article Data, Predictions and Participation: Navigating the Nuances of Next-Gen CX in 2024 CMSWire predicts that seamless omnichannel integrations will be one of the core considerations for the next level of effective digital transformation.

What happens when you don’t consider CX in your digital transformation strategy?

When a digital transformation strategy neglects or fails to consider CX, several areas can be impacted, across the organisation, from business development to marketing, beyond the technical and information management parts of your business

- Customer satisfaction: Ignoring CX may result in solutions that don’t align with customer needs and expectations. This in turn will affect loyalty and retention.

Low customer satisfaction scores may contribute to higher churn rates as customers seek better experiences elsewhere. This can have a significant impact in the highly competitive financial services, banking, insurance and superannuation sectors where customer loyalty is always a key component of growth strategies.

Poor customer experiences can also lead to negative perceptions of the brand. Social media and online reviews can amplify dissatisfaction, damaging the company’s reputation. - Revenue: Focusing on CX provides opportunities to enhance products or services based on customer feedback. This can also improve competitive advantage by opening up new markets and revenue streams.

- Employee buy-in: Staff may resist or struggle to adopt new technologies and processes that do not consider the customer experience. Resistance can slow down the implementation of digital transformation initiatives.

- Digital transformation implementation: Without a customer-centric approach, digital transformation initiatives may not address the real consumer pain points. This can result in ineffective solutions that don’t deliver the expected benefits, resulting in implementation cost blowouts and delays.

- Resource efficiency: Investing in digital transformation without considering CX may mean you’re using financial resources and time for a solution that does not provide value to customers.

- Innovation: An approach that does not consider CX can stifle innovation. If you’re not meeting evolving customer needs you could easily miss opportunities to develop groundbreaking products or services

- Regulatory compliance: Ignoring the impact of digital transformation on customer data privacy and compliance can result in legal and regulatory risks, leading to fines and reputational damage.

Measuring the value of CX digital transformation

By investing in CX as part of your digital transformation strategy, the aim is to improve customer experience. The proof is in the pudding, and you can measure the success of a customer experience focus with tools such as:

- customer satisfaction surveys

- Net Promoter Score (NPS) *

- customer retention rate

- conversion rates on leads

- analytical tools to measure engagements, click-through numbers and digital interactions.

* Gartner research has also found that in the financial services sector, a financial empowerment score (FES) can be a stronger measure than NPS

Measuring these against previous data and the company’s updated goals for CX will allow you to gauge the overall success of the changes that have been applied during the digital transformation project.

Does your digital transformation strategy need a CX lens?

Are you ready to integrate customer experience considerations into every phase of your digital transformation strategy? Contact 9Yards digital transformation consultants to get the conversation started.